| Jonathan Andreas |

Bluffton University |

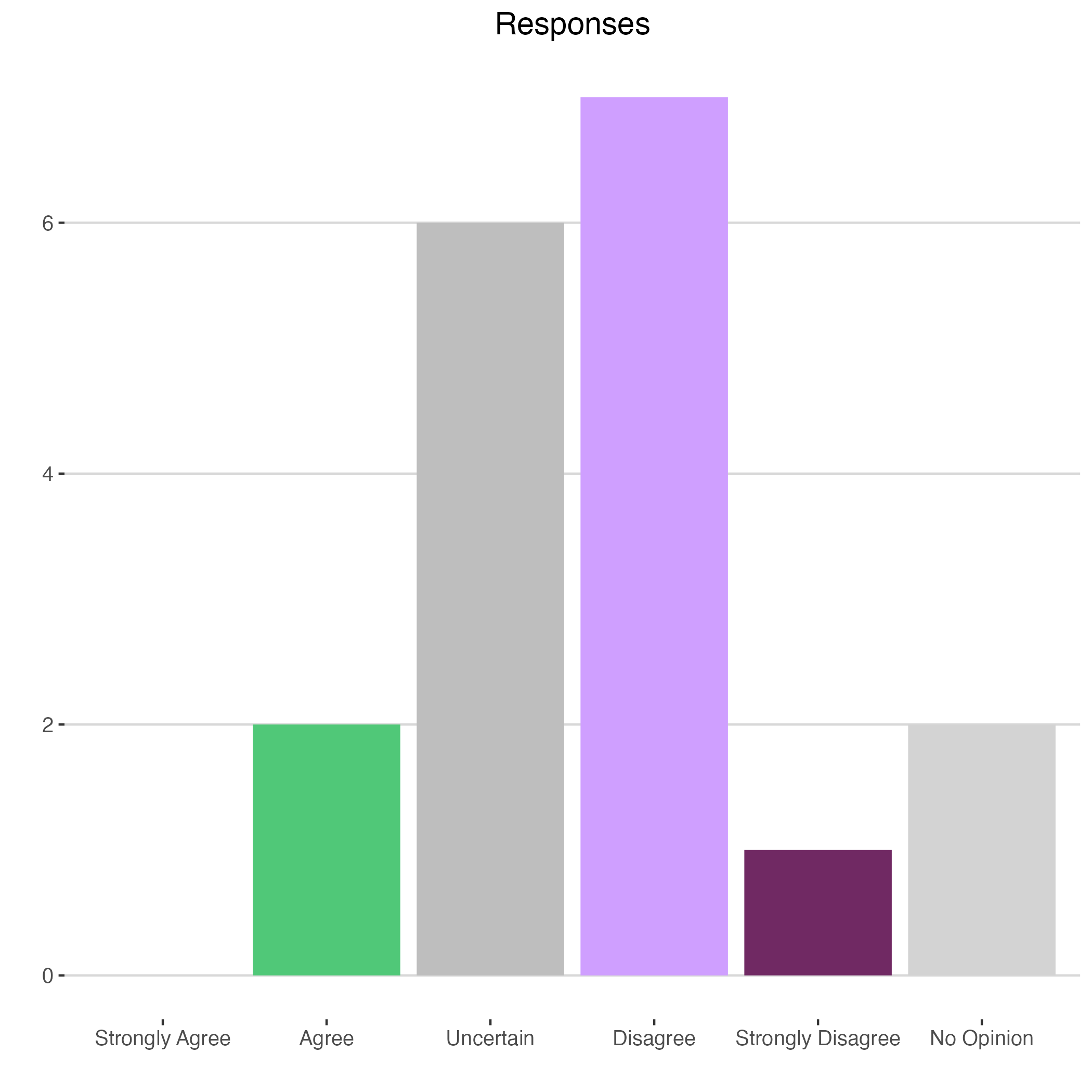

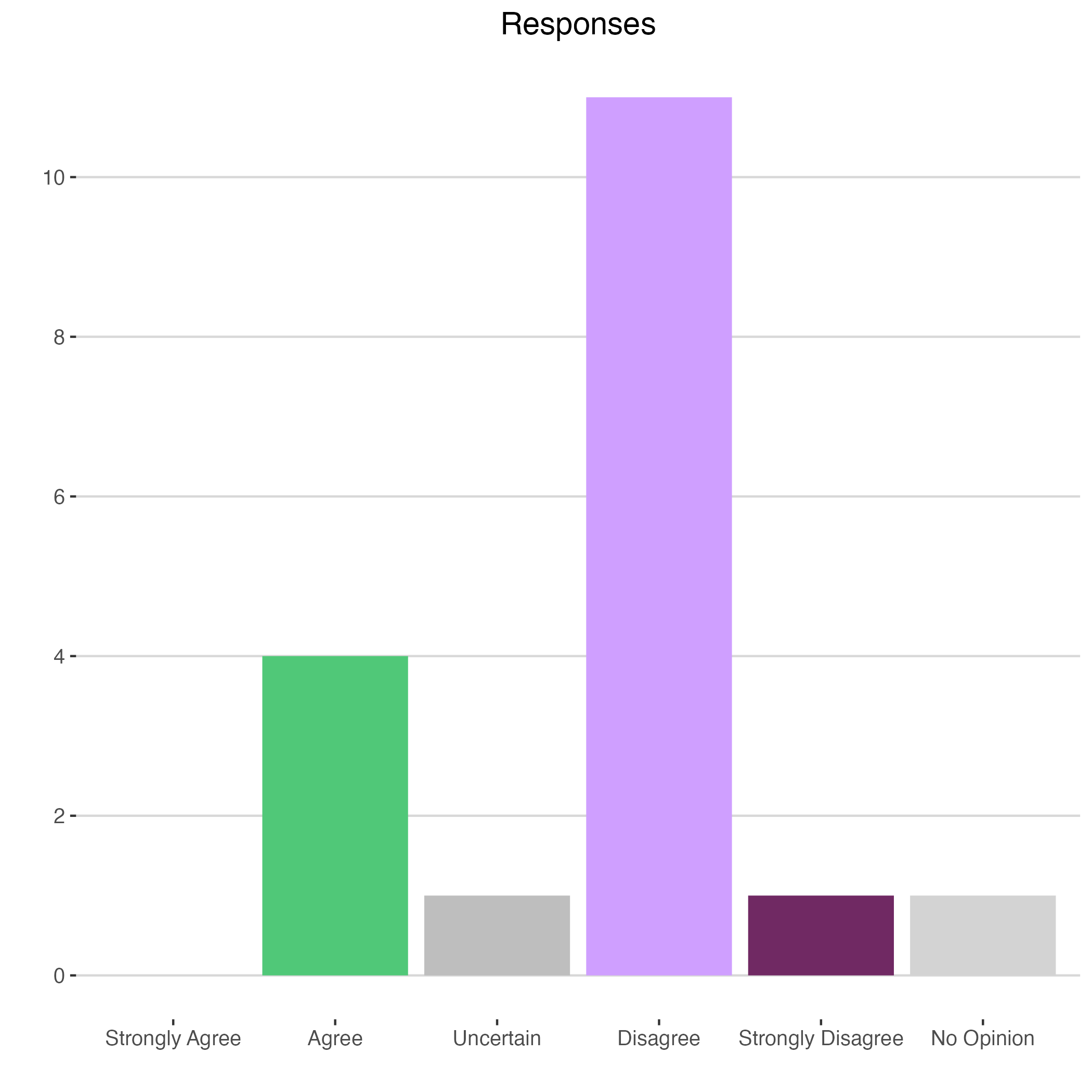

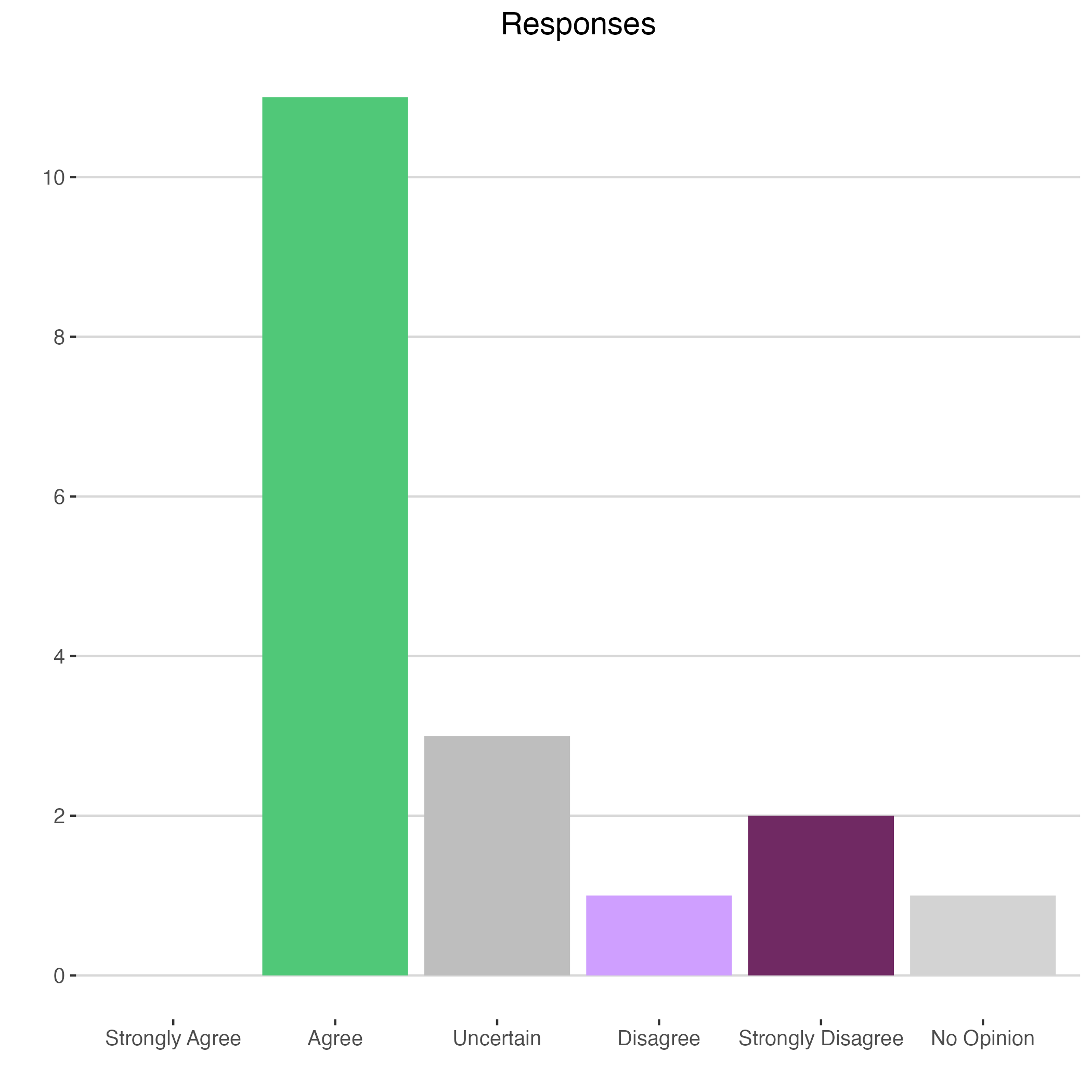

Uncertain |

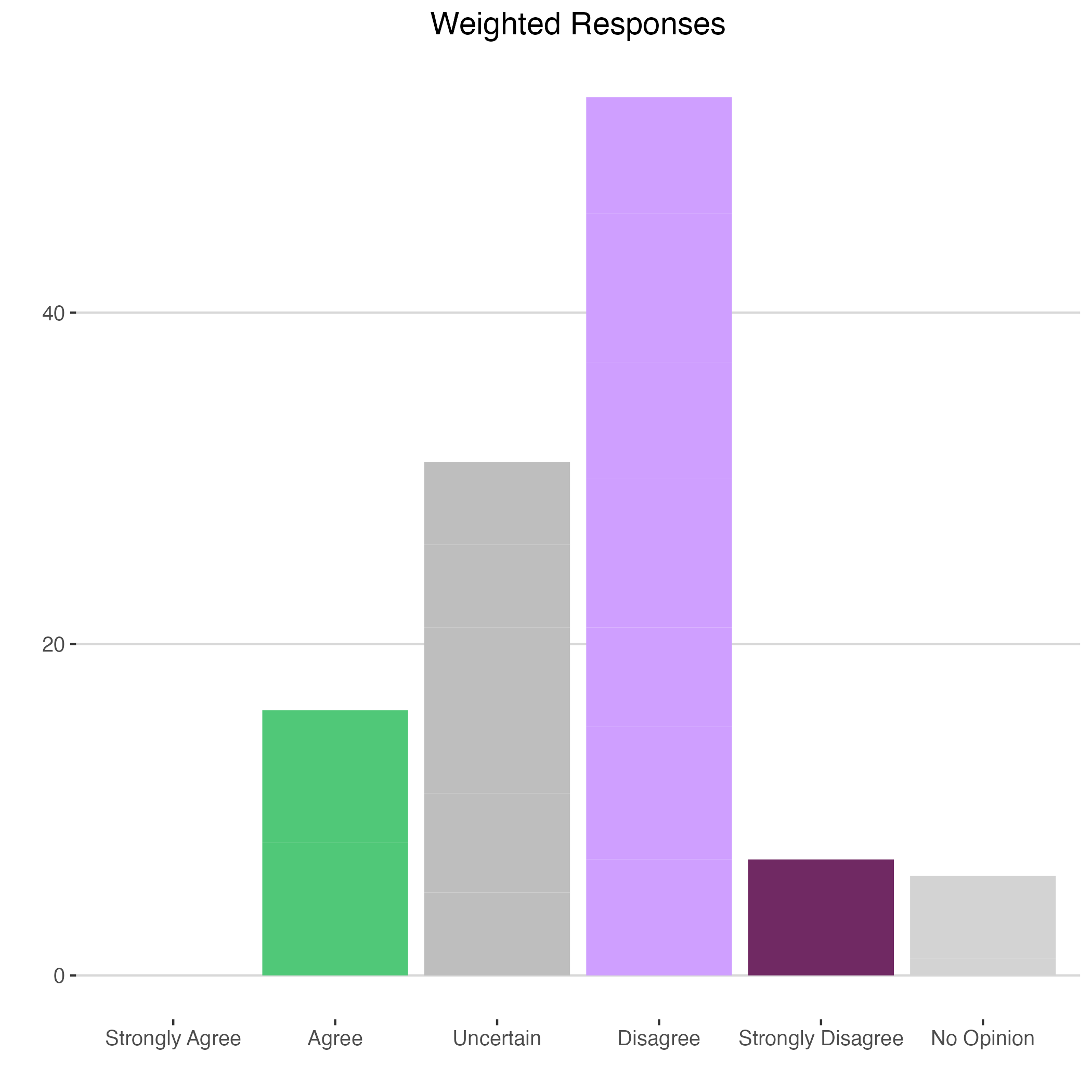

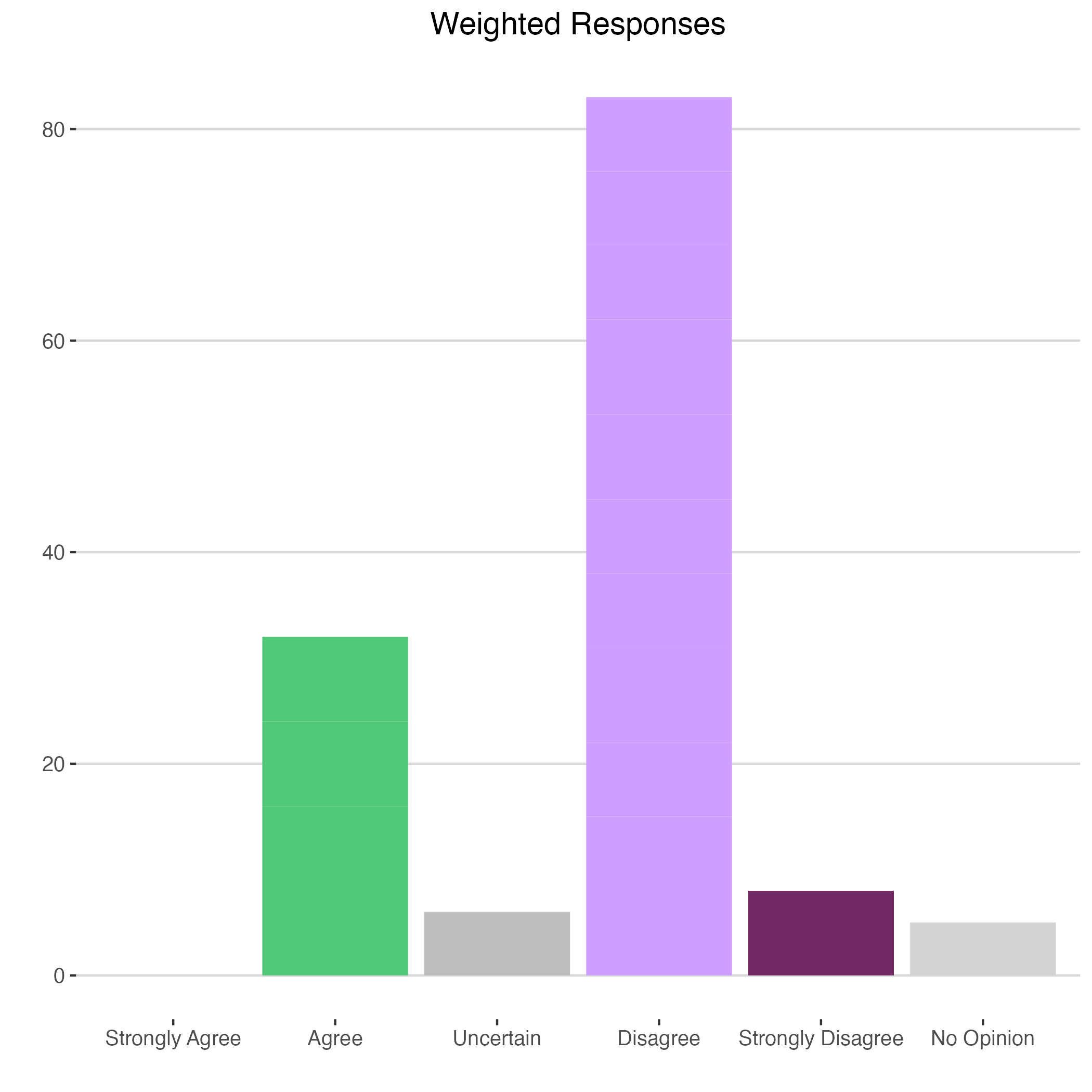

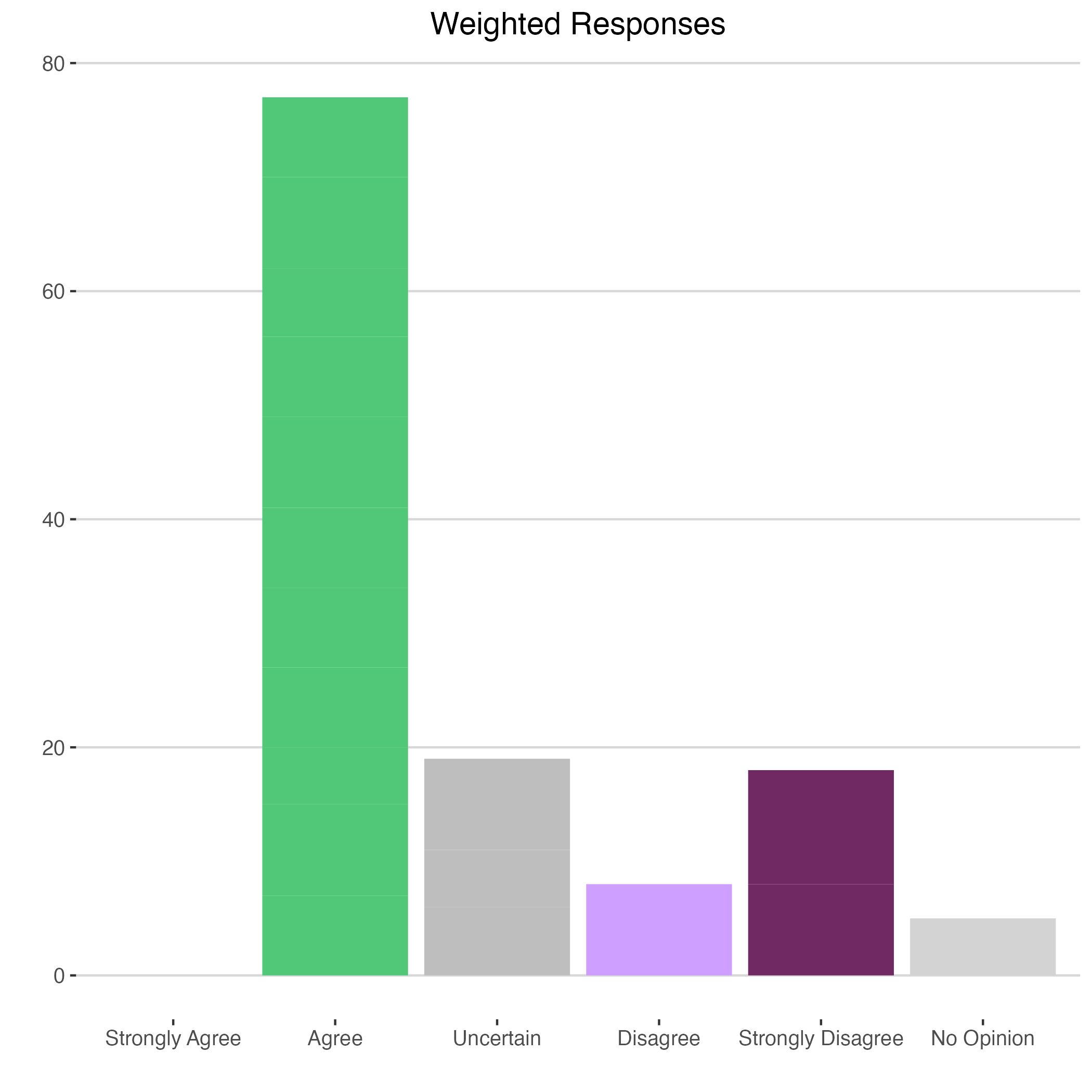

6 |

Again, nothing is perfect, but some parts are well aligned and others are not. I'd need more specifics about what part you are focused upon to give an opinion. Without more focus, each respondent is is just going to be thinking about different aspects and talking past one another about issues that policymakers don't care about rather than focusing on something concrete that policymakers are interested in where analysis might have some leverage to change minds and shift policy. |

| David Brasington |

University of Cincinnati |

Agree |

8 |

Ohio has pretty low educational attainment compared to other states, and even 40% of Ohio workers trained for manufacturing jobs tend not to get manufacturing jobs within a year, consistent with a mismatch of skills and demand for skills. |

| Ron Cheung |

Oberlin College |

Agree |

7 |

|

| Kevin Egan |

University of Toledo |

Strongly Disagree |

8 |

I don't think any of these factors are in the top 5 reasons. I think number 1 is "quality of life" which includes so many things: quality of schools, quality of environmental amenities, quality of entertainment opportunities, affordability, etc. I think the role of the state is to collect the taxes it needs to support these quality-of-life attributes. A tax cut that starves funds for schools, roads, parks, and other public investments is a net negative. |

| Kenneth Fah |

Ohio Dominican University |

Uncertain |

5 |

|

| Vinnie Gajjala |

Tiffin Univeristy |

Uncertain |

8 |

|

| Will Georgic |

Ohio Wesleyan University |

Agree |

7 |

This isn't the primary driver of the lack of job growth, but statewide job growth could be improved with better alignment between the skills which employers are seeking and the skills which potential employees may have. |

| Bob Gitter |

Ohio Wesleyan University |

Agree |

7 |

This is somewhat true but the key is training in the soft skills for younger workers and I am not sure how this could be improved. |

| Paul Holmes |

Ashland University |

Agree |

8 |

I think this is a general American problem, not specifically an Ohio problem. I'd love to see more emphasis on trades and less on general college-level training. |

| Christian Imboden |

Bowling Green State University |

Agree |

7 |

This is not unique to Ohio, however. |

| Charles Kroncke |

Mount Saint Joseph University |

Strongly Disagree |

10 |

|

| Bill LaFayette |

Regionomics |

Agree |

7 |

Based on my work with educational institutions, linkages between these institutions and business need to be enhanced. It has always been important for graduates to leave school with the work-ready skills (communication, responsibility, integrity, leadership, teamwork, etc.) that can spell the difference between success and failure in a career. But now with the pace of technological change, schools need to keep up with the rapidly evolving needs of business, and graduates need to recognize that they must keep their skills current or run the risk of irrelevance. |

| Trevon Logan |

Ohio State University |

Agree |

8 |

|

| Michael Myler |

University of Mount Union |

No Opinion |

5 |

|

| Joseph Nowakowski |

Muskingum University |

Agree |

7 |

|

| Curtis Reynolds |

Kent State University |

Disagree |

8 |

This is probably true for a small subset of jobs but the forces affecting Ohio are more external. Long-term declines in manufacturing due to technology and trade have had a very negative effect in Ohio. And population change (mostly demographics but possibly some migration) have changed the potential workforce. Say that the potential workforce are people age 16-75. In 1980, 32% of those people were 16-29 (at the start of their careers) and 15.5% where 60-75 (at the end of their careers). In 2000 those numbers were 24.4% and 15.9% and by 2023 they were 21.4% and 24.4%. So the potential labor force is aging meaning less people likely to be available for work. |

| Albert Sumell |

Youngstown State University |

Agree |

6 |

I don't have a strong opinion on this. I believe there is misalignment which can have an impact on our long term growth, but I'm not confident in how significant the misalignment is |

| Ejindu Ume |

Miami University |

Agree |

5 |

|