| Jonathan Andreas |

Bluffton University |

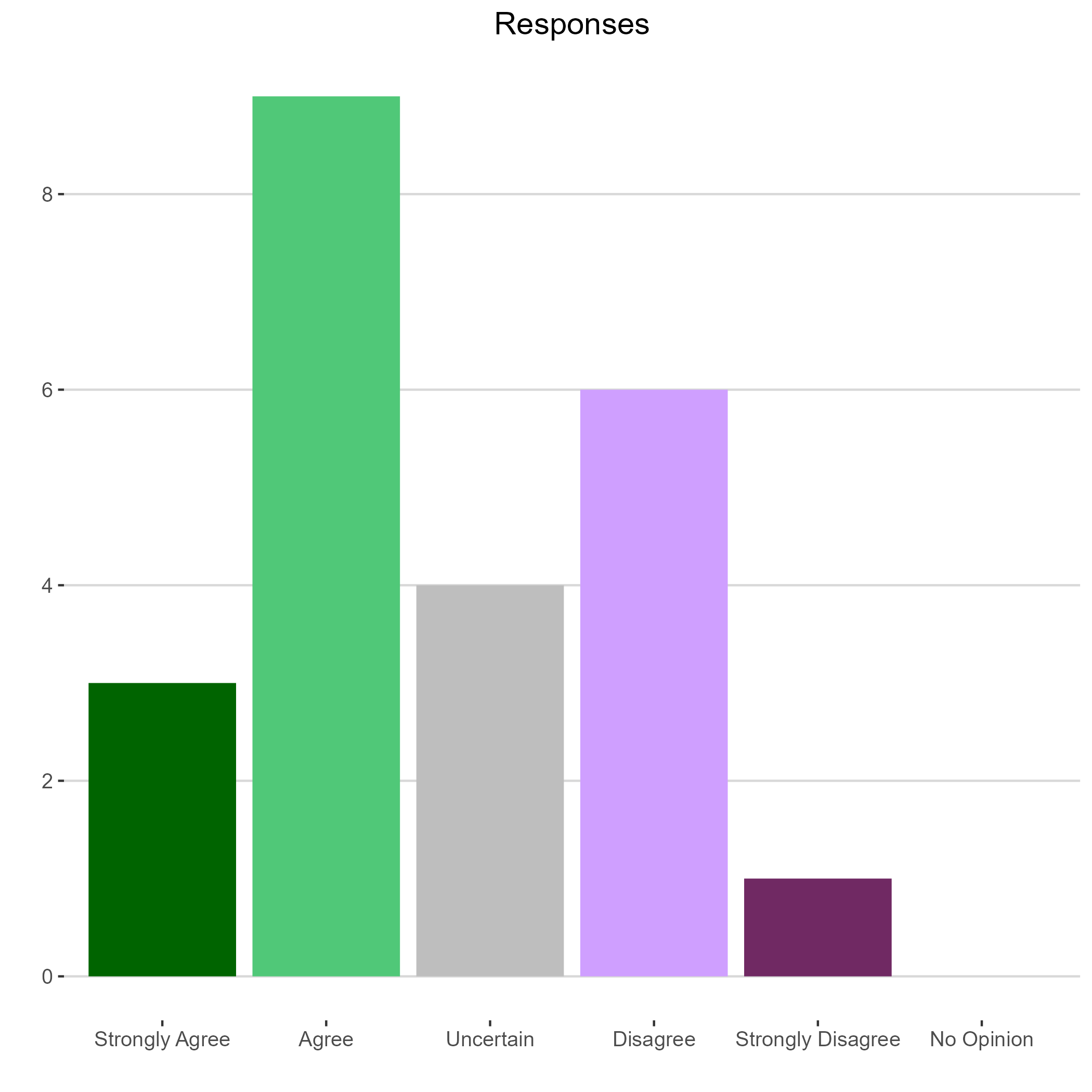

Agree |

8 |

There is only a small short-run effect of higher prices because they are addictive, but it has a big effect on teens who are deterred from starting and it helps motivate addicts to quit in the long run. The main problem is substitutes from illegal tobacco sales and I hope this is going to apply to vapes which is the main growing problem. |

| David Brasington |

University of Cincinnati |

Disagree |

8 |

more effect on young people, who have lower purchasing power |

| Jay Corrigan |

Kenyon College |

Agree |

6 |

|

| Kevin Egan |

University of Toledo |

Agree |

10 |

Yes, this is the law of demand: increasing the price of cigarettes will reduce the quantity demanded. Note that particularly young adults are sensitive to higher prices. Though, even older adults with tobacco addiction have been shown to smoke less as well when prices are higher. However, most importantly, with higher prices, less citizens in the future will have a tobacco addiction. |

| Kenneth Fah |

Ohio Dominican University |

Disagree |

9 |

|

| Will Georgic |

Ohio Wesleyan University |

Agree |

8 |

The increase in the cigarette tax would lead to a statistically identifiable decrease in cigarette consumption, but the relative reduction in cigarette consumption would almost assuredly be in the low single digits. |

| Robert Gitter |

Ohio Wesleyan University |

Uncertain |

8 |

Once again, what is meant by significant. I would imagine that sales would go down by 3-4 % and probably more so for younger smokers. |

| Nancy Haskell |

University of Dayton |

Agree |

7 |

|

| Paul Holmes |

Ashland University |

Uncertain |

6 |

Older 'established' smokers probably would likely continue their smoking patterns. Younger people are probably a little less likely to take up smoking. But 40c is not large, especially in the context of current wages available to younger people, so I doubt much of an effect. |

| Faria Huq |

Lake Erie College |

Agree |

6 |

The effects are likely to vary based on demographics. There will be some reduction in cigarette consumption although I am uncertain about whether the reduction will be significant. |

| Michael Jones |

University of Cincinnati |

Uncertain |

5 |

|

| Charles Kroncke |

Mount Saint Joseph University |

Disagree |

9 |

|

| Bill LaFayette |

Regionomics |

Disagree |

7 |

A reduction, yes. Probably not significant given the addiction that develops. |

| Trevon Logan |

Ohio State University |

Uncertain |

7 |

|

| Joe Nowakowski |

Muskingum University |

Disagree |

8 |

|

| Curtis Reynolds |

Kent State University |

Disagree |

10 |

Research is clear that demand for cigarettes is very inelastic, so increases in prices does not lower cigarette consumption much (an older literature suggested larger decreases for teenagers but more recent studies find smaller effects). Depending on which estimates you look at, this tax might reduce cigarette consumption by about 1-5%. And there is strong evidence of tax avoidance (casual smuggling from other states) which would further lower the effects towards zero. |

| Kay Strong |

Independent |

Disagree |

9 |

|

| Iryna Topolyan |

University of Cincinnati |

Disagree |

7 |

|

| Ejindu Ume |

Miami University |

Disagree |

8 |

|

| Andy Welki |

John Carroll University |

Disagree |

8 |

|

| Kathryn Wilson |

Kent State University |

Agree |

7 |

Studies have shown that higher cigarette prices reduce the likelihood that youth will begin smoking and reduce cigarette consumption among youth. The results for adults is generally not as strong. I agree that the tax would likely result in a reduction in cigarette consumption, particularly among youth, but I don't know that the tax increase would be enough to significantly reduce consumption overall. |

| Rachel Wilson |

Wittenberg University |

Uncertain |

8 |

Studies have shown that cigarettes are inelastic. In other words, a 10% increase in prices would lead to a less than 10% decrease in quantity demanded. But, it would still lead to a decrease in quantity demanded. |